Over the years I have been true to the Gann material that I knew was entrusted to me. I haven’t always been able to describe, nor explain many of the items I have. All I can tell you is that something has told me, “ it is time” to release this material.

Writing about Mr. Gann’s Ephemeris, all I have are memories—and that’s what this thing is going to be. This is why I have asked a trusted friend to help me write a description that will describe these volume’s to you so they will be an asset to your trading.

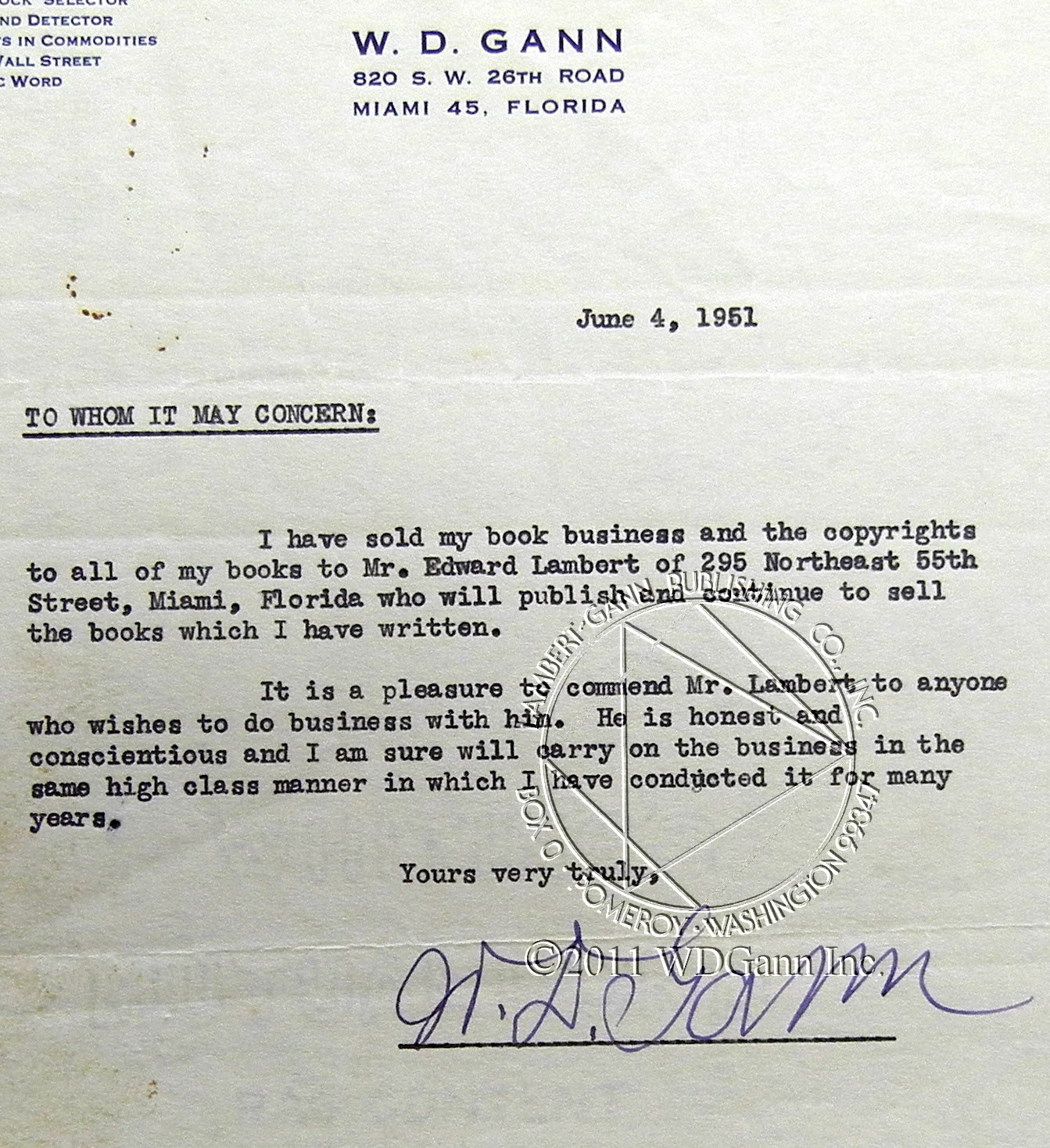

I can’t say I saw Ed Lambert hand these volumes to Billy. All I remember is Ed really getting upset when certain boxes of books were uncovered and packed to the awaiting truck and impatient driver.

I could write pages on Mr. Lambert however that is another story. Ed shook and sweated and he was not really sure if this material, that had been buried for so long, should be part of the deal he & Billy had made. Time was up, the door of the truck closed and it was on its way to Washington State.

I remember three extremely affluent men at our farm. I was serving tea in the office when I heard the words,” loan or borrow” as they were looking at the bookshelves. I do know that years later as I sat alone in the office of Lambert-Gann looking for material to help me understand anything, a letter appeared in a drawer I swear I had looked in dozens of times. It was a letter from one of the original three that had visited Billy. He spoke of the Ephemeris and I believe that was as far as I read. I reached for the phone, immediately called.

Unaware the phone was answered on the other side of the world. Splutters, excuses, and “oh, yes, there was a meeting tonight” and “oh, yes, I can bring the Ephemeris”—the exchange was made and the Ephemeris after being absent for many years flew back home. It has been safely locked away since then.

No matter how my hopes shall fail,

Or how I fall behind,

I’ll not sit down tonight to wail

That God has been unkind.

But, with a duty to fulfill,

And with a proud, defiant glance,

I’ll prove that still

I have the courage and the will,

And gird me for tomorrow’s chance.

Tunnel through the Air, pp. 144-145

-Nikki Jones

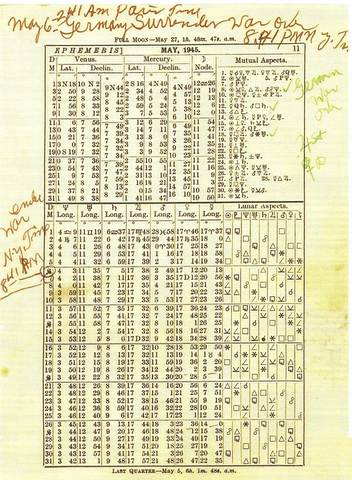

An ephemeris is a table of values that gives the positions of astronomical objects in the sky at a given time or times. The Raphael ephemeris gives the apparent geocentric positions of the Sun, Moon and planets, as seen as from the center of the earth.

The Raphael ephemeris tables the ASPECTS, ZODIACAL SIGNS and PLANETS along with ECLIPSES and other PHENOMENA on a given date.

W.D. Gann’s Personal Annotated Copy of Raphael’s Ephemeris 1941 to 1950

There is a lot written during the time period of the Ephemeris 1941 to 1950.

The chart “Path of Planets Chart #4” contained in the Commodities and Stock Market Courses correlates with the first two years of the W.D.Gann Ephemeris

Consider that W.D Gann published the following in and around the Time Cycle of 1941 to 1950

On May 24th 1940, right at the start of his booklet “Face facts America and Looking Ahead To 1950”…..W.D. Gann stated

“In 1927, when I wrote “The Tunnel Thru The Air or Looking Back From 1940” by the use of Time Cycles that I have discovered……All of these things I predicted”

See further extracts from “The Tunnel Thru The Air” as to astrological points.

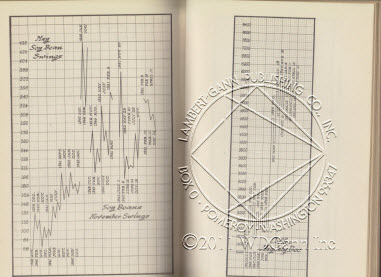

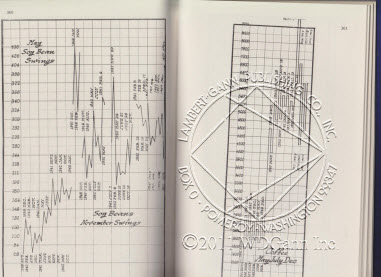

On September 14th 1941, Mr. Gann forecast the top for Soy Beans and sold short, making large profits on the decline. (Extract from “W.D. Gann Economic Forecaster”)

Read the book, see the forecasts and build the charts for yourself. It may help you to understand how W.D. Gann applied the facts or Phenomena from the Ephemeris on the specific dates he included in the book.

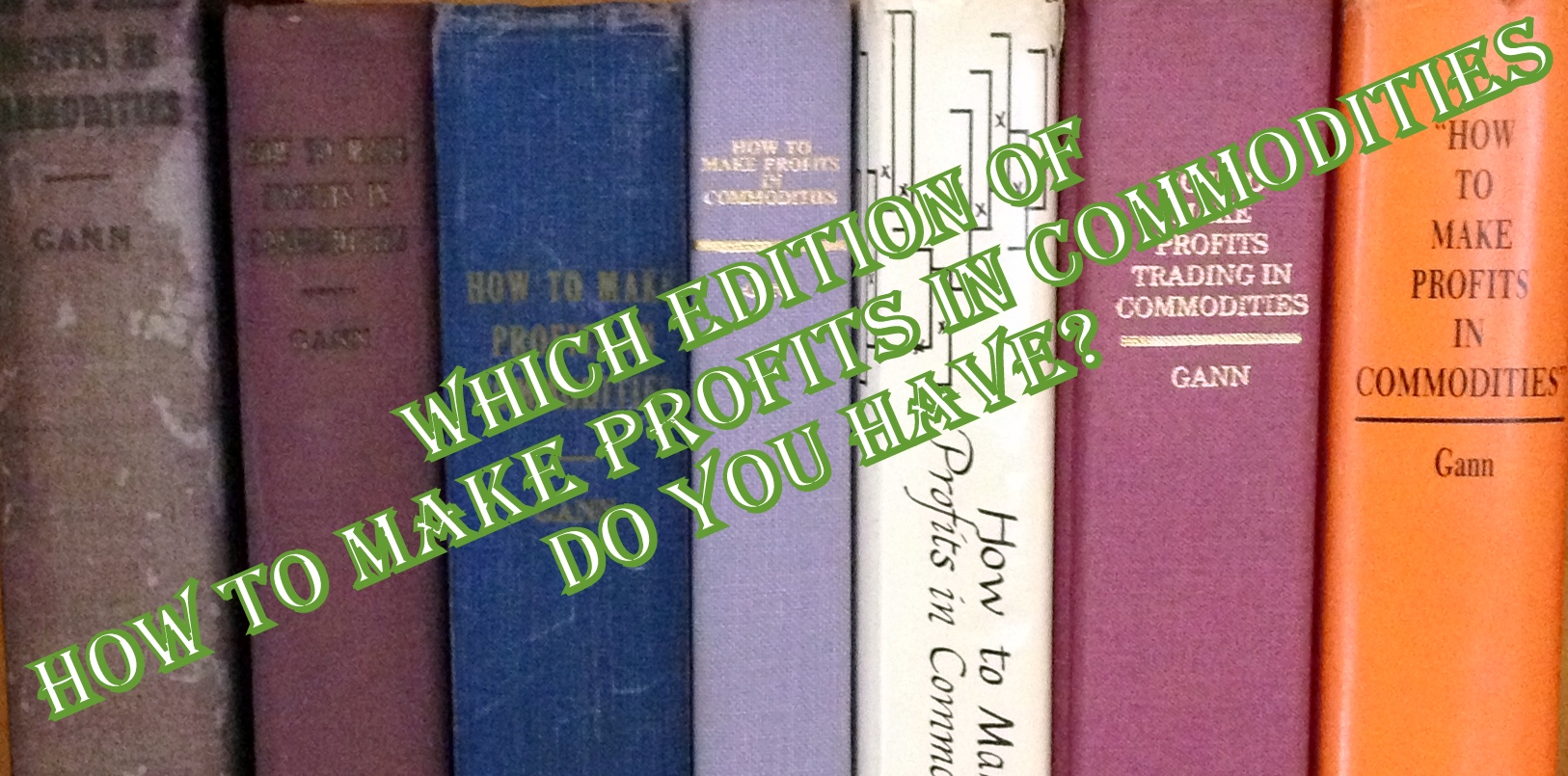

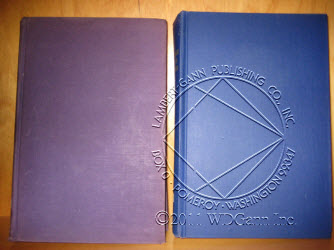

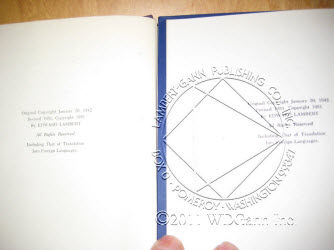

On June 6th 1951 “How to Make Profits in Commodities” was published.

A careful comparison of the two editions shows up some very interesting changes. For example, why are the charts on pages 359 to 366 revised and showing swings long past W.D Gann’s publication date of 1951 and his death in 1955?

He was clearly making Forecasts using an EPHEMERIS.

On July 18th 1949, Gann signed and published“45 Years In Wall Street”

Read the book, see the forecasts and build the charts for yourself. Again it may help you to understand how W.D.Gann was working. In particular read Chapter VIII, pages 82 to 89. The chapter is called “Months When Extreme Highs and Lows Were Recorded”.

Below are some extracts and references contained in “The Tunnel Thru The Air, or Looking Back From 1940” that clearly identify W.D Gann was using Astrology and Data coming from the tables in an Ephemeris.

This story is founded on facts and events, many of which have happened or will happen in the future. It has been well said that truth is stranger than fiction.

FOREWORD

- Second, It teaches a moral lesson and proves the Natural laws laid down in the Bible.

- Third, It shows the value of science, foreknowledge and preparedness.

Page 66

- “I have read in the tables of heaven (Ephemeris) whatsoever things shall befall both of you and your children.”

- I believe in the stars, I believe in astrology, and I have figured out my destiny.

- The Bible makes it plain that the stars do Rule

- “He tellest the number of the stars,

Page 67

- I have demonstrated this to mean that the planets rule our Destinies.

Page 171

- his only faith was in astrology, and science laid down in the Bible

Page 172

- His calculations showed that wheat and cotton should be top for a reaction on June 10th so he wired his broker in New York to sell out his wheat and cotton. Corn was down that morning, so he telegraphed the broker to buy 20,000 bushels of September corn. After sending this telegram, he glanced over the morning paper and saw an advertisement headed, “Professor O. B. Joyful, ”Astrologer.

Robert eagerly read the advertisement because the name attracted him. And he was looking for something to make him joyful. Professor Joyful’s advertisement stated that “with the science of Astrology, he could tell when success would start, when trouble would end and reveal when marriage would take place.”

Robert was a great believer in Astrology because he had found this great science referred to so many times in the Holy Bible. Robert remembered reading in the Psalms 111: 2:

The works of the Lord are great, sought out of all them that have pleasure therein. He had made notes as he read the Bible at different times where it referred to Astrology or the signs in the heavens and was thoroughly convinced that the influence of the heavenly bodies govern our lives.

Throughout “The tunnel thru the air” there are extensive references to CYCLES, PAST and FUTURE, MAJOR and MINOR CYCLES, references to the SUN, MOON, MARS, SATURN,VENUS, URANUS, JUPITER, CHANGING SIGNS, ASPECTS, CONJUNCTIONS, TRANSITS AND MUCH MUCH MORE.

All of these details are obtained from an EPHEMERIS

Note that W.D.Gann of Gemini and Sepharial of Pisces were on the ZODIAC COUNCIL of THE ASTROLOGICAL SOCIETY,INC N. Y. in February 1914 ( See. Sepherial’s The Science of Foreknowledge 1918)

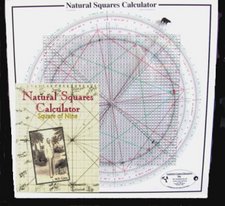

Will you be one of the 400 people in the world to own this treasure?

Click here to buy W.D.Gann’s Private Ephemeris now.

Currency Converter

Currency Converter